Top 7 Common Scams in Singapore

Scammers are getting increasingly sophisticated in their attempts to get your money or personal details. More people were also tricked into providing their credit card details in phishing scams where tricksters impersonated banks, government agencies, and even Netflix. Be alert and protect yourself from being scammed by following our tips.

The Five Main Scam Signs

The most common scams follow a simple pattern, and once you understand that, you’ll be able to spot the signs and avoid being a victim, now and in the future.

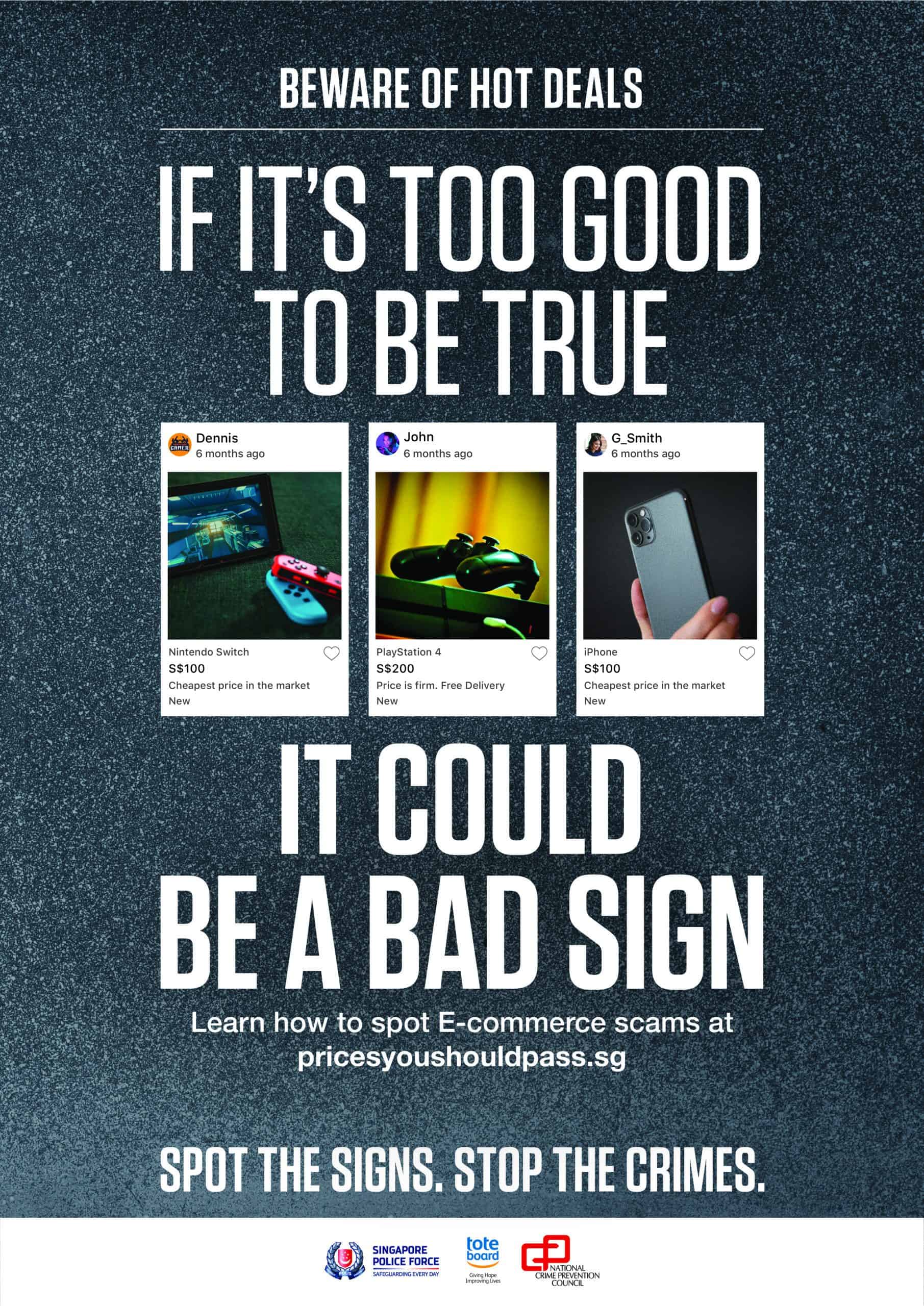

Tempting Offers

Don’t be fooled by tempting offers. If it sounds too good to be true, it probably is. This sign appears in many scam cases such as loan scams, e-commerce scams, investment scams, job scams and money laundering offences.

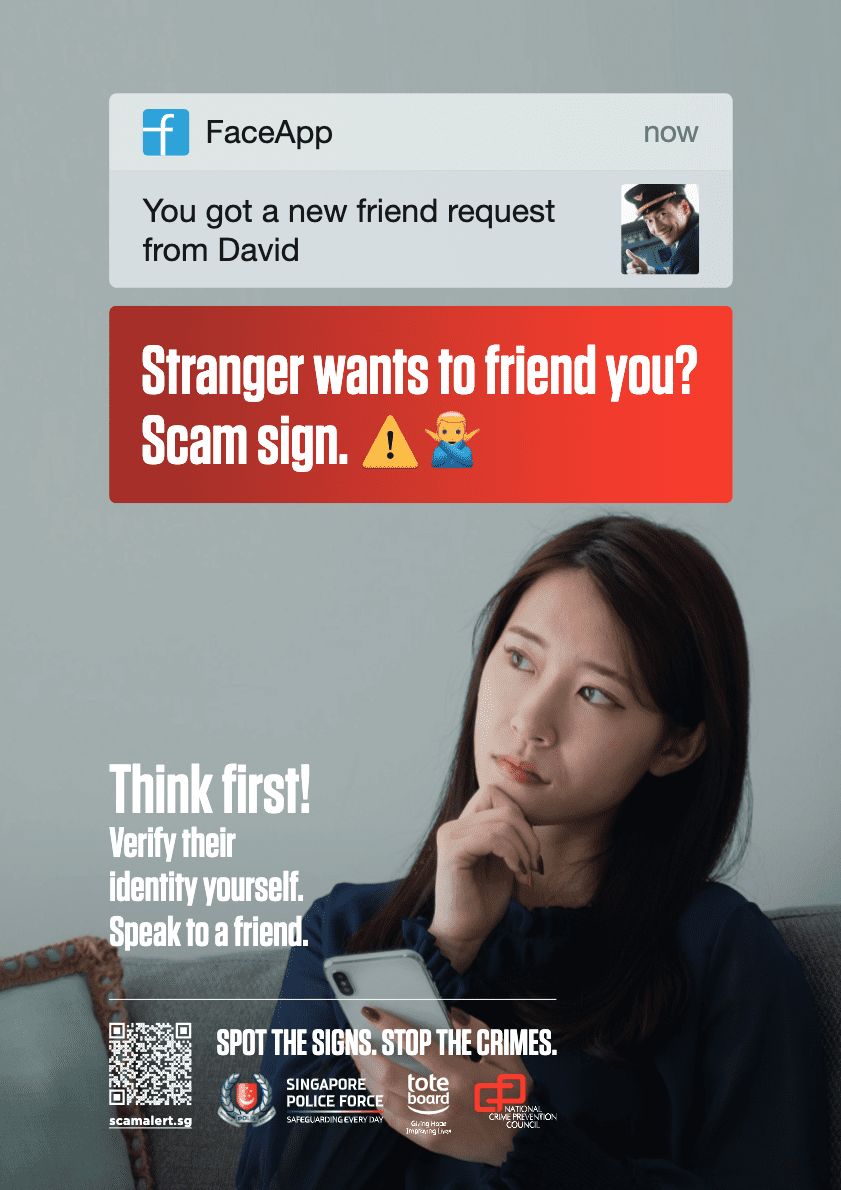

Unexpected Friend Requests

Don’t be tricked by friendly strangers. Social networking platforms, dating sites and online forums allow scammers to “Befriend” you, enter your personal life and access your personal details. Accepting unknown friend requests online can expose you to dangers such as internet love scams.

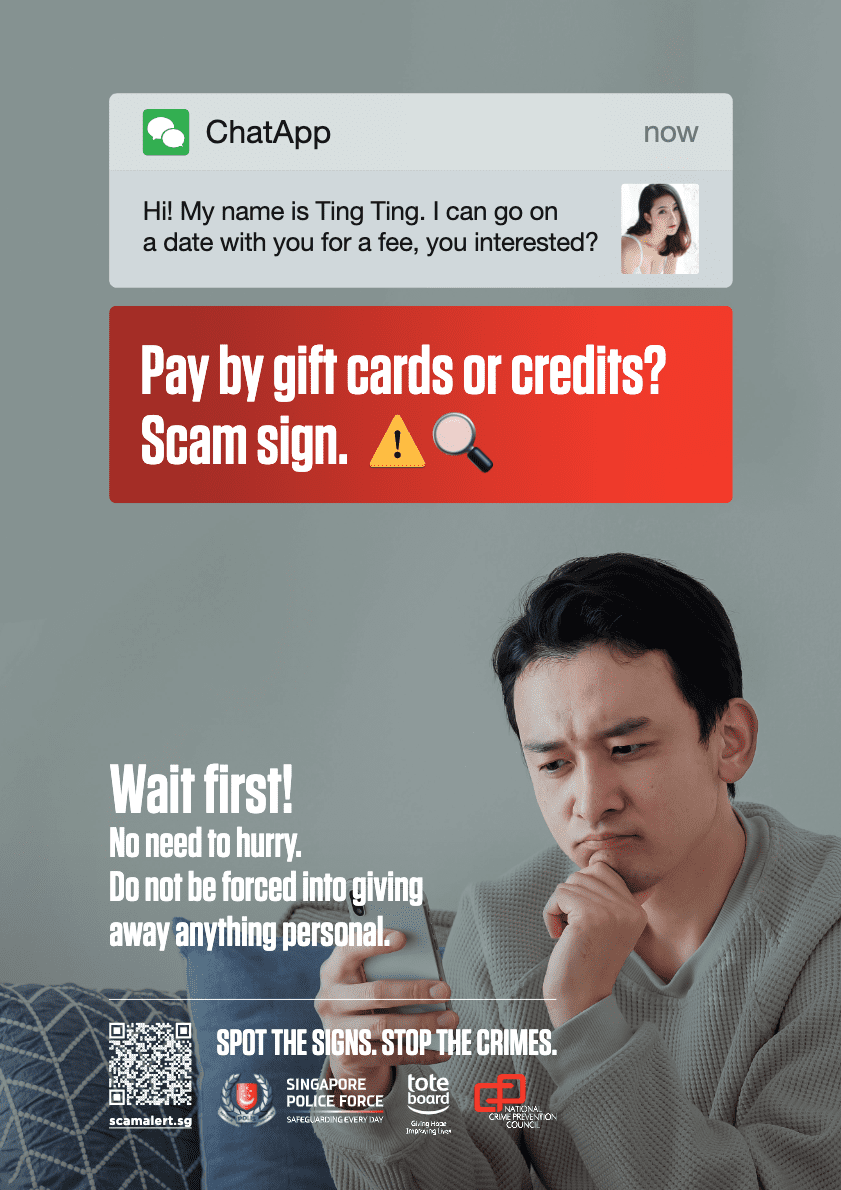

Pay By Gift Cards Or Credit

Don’t get seduced by looks. An attractive, unsolicited friend or an online listing may ask you for up-front payments in exchange for escort, massage or sexual services. Watch out for credit-for-sex scams.

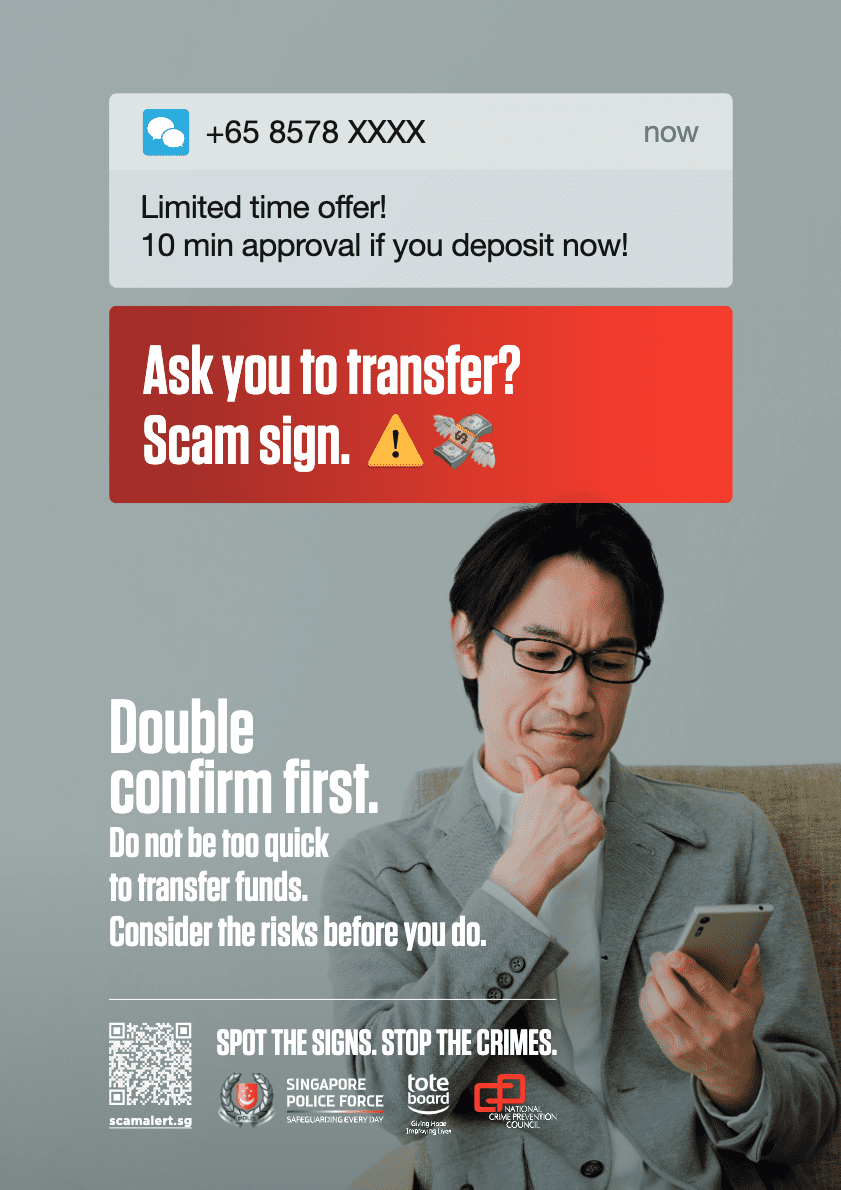

Urgent Money Transfers

Don’t transfer funds without checking. Scammers may pressure you to make funds transfers by creating a sense of urgency. By doing so, scammers want victims to react emotionally rather than rationally. This sign may appear in e-commerce scams, social media impersonation scams, china officials impersonation scams, internet love scams, credit-for-sex scams or money laundering.

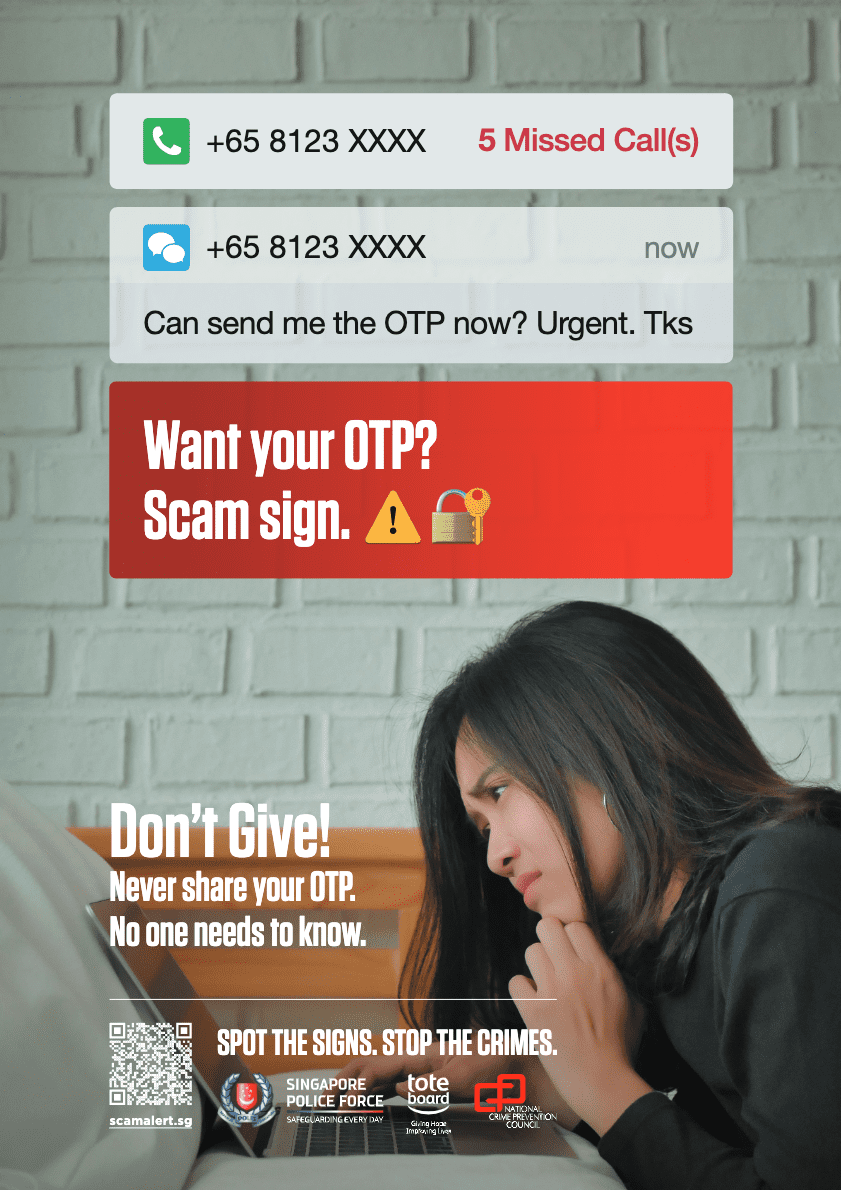

OTP Requests

Don’t share your OTP ever. It’s surprisingly easy for scammers to disguise their identity and create believable stories to trick you into handing over your personal details, including confidential information such as your one-time password (OTPs). Look out for these sign in social media impersonation scams, non-banking and banking-related phishing scams and china officials impersonation scams.

Top Seven Scams

Ensure your safety and that of others by familiarising yourself with common methods of fraud. Here are the top seven scams in Singapore:

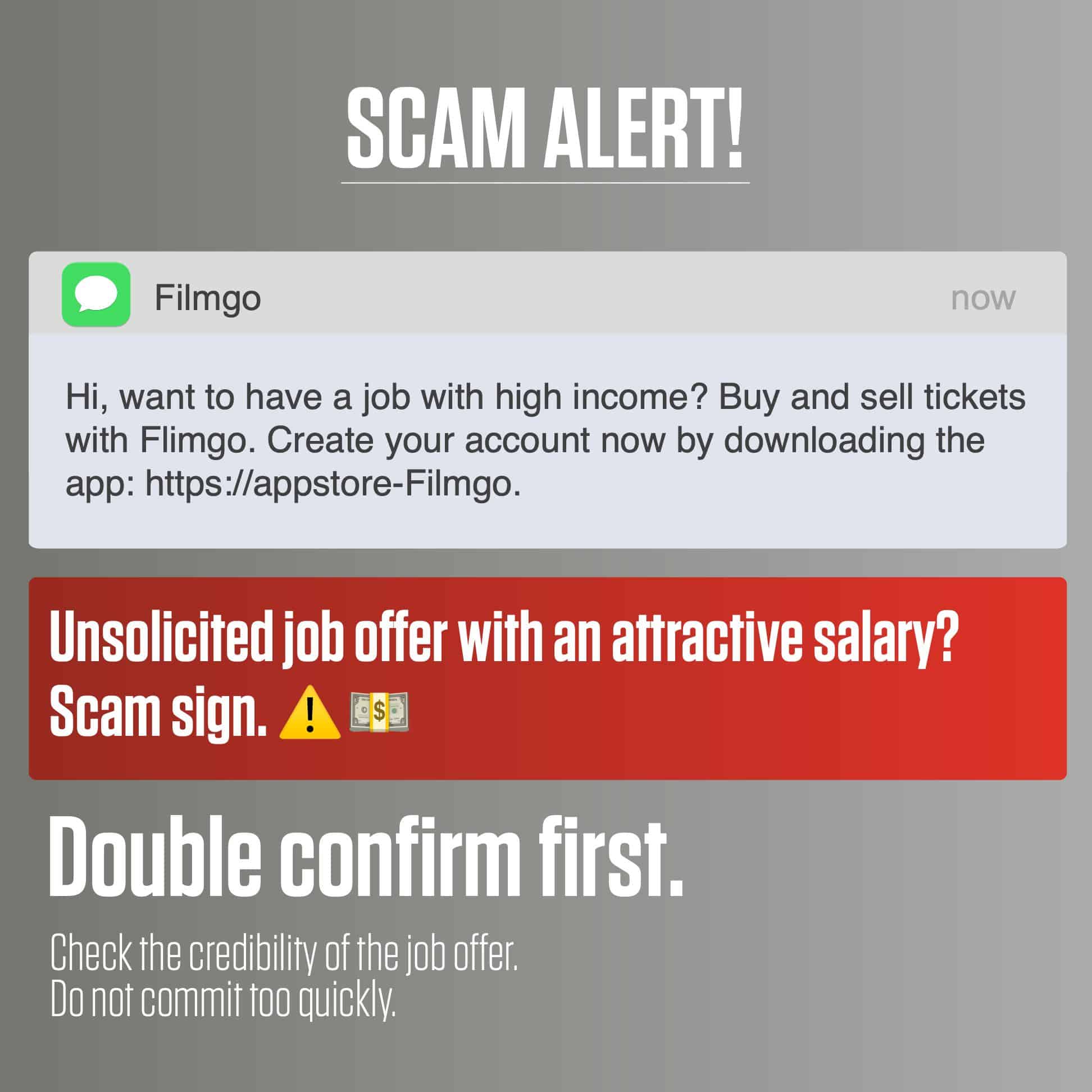

1) Job Scam

Beware, as job scams have skyrocketed, with at least $91 million lost to conmen this way in 2021.

These scams often involve potential applicants receiving unsolicited job offers via messaging apps, social media, etc. Very often, potential “employers” would offer applicants high-paying jobs that require little effort.

Job scams can come in many forms and some variants are:

Affiliate Marketing

In this version, scammers will offer “Affiliate Marketing” jobs where victims are asked to help boost sales of sellers by paying for products in advance in return for commissions. Such payments are often made to private bank accounts.

Using Personal Bank Accounts

In this scam, scammers will offer jobs that require applicants to do the following in return for a small commission:

a) Processing fund transfers by receiving money into their personal bank accounts and then transferring the money out through online banking or money transfer services such as Western Union or MoneyGram

b) Open bank accounts using their names for a business, or

c) Receive a donation into their personal bank accounts and assist to deposit the money into a crypto kiosk.

Assistant Purchasers

In another variation of this scam, scammers place online job ads for assistant purchasers, stock takers or participants for a system trial on popular classified websites like Gumtree. Participants are asked to reveal personal details like their names, IC numbers, phone numbers, phone security codes and one-time passwords (OTP). Information like this allows scammers to access your mobile phone lines to purchase online credits.

Tip: Do not accept dubious job offers that promise high income with minimal effort or download applications from unverified sources.

2) Online Purchase Scam

Victims of this scam are often tempted by what seems like a good deal for a gadget, amusement park or concert tickets sold online. They transfer payment to the “seller” who promises delivery of the item. In some cases, sellers demand further payment for duties or delivery charges after the first payment is made. Ultimately, the victim never receives the item.

Cash-on-Delivery scam

In another variant, victims who opted for may be asked to pay in cash for parcels they did not purchase, not what they have bought or cheap replicas.

Many of these fake sellers may pose as legitimate online sellers on popular marketplaces, create fake websites, or even place advertisements on social media to build credibility.

Victims will realise that they have been scammed after paying for the items in cash.

Tip: Stick to making purchases from online platforms with an in-built function that only releases payment to the seller once the item has been received. And if an item’s price looks too good to be true, it’s probably a fake.

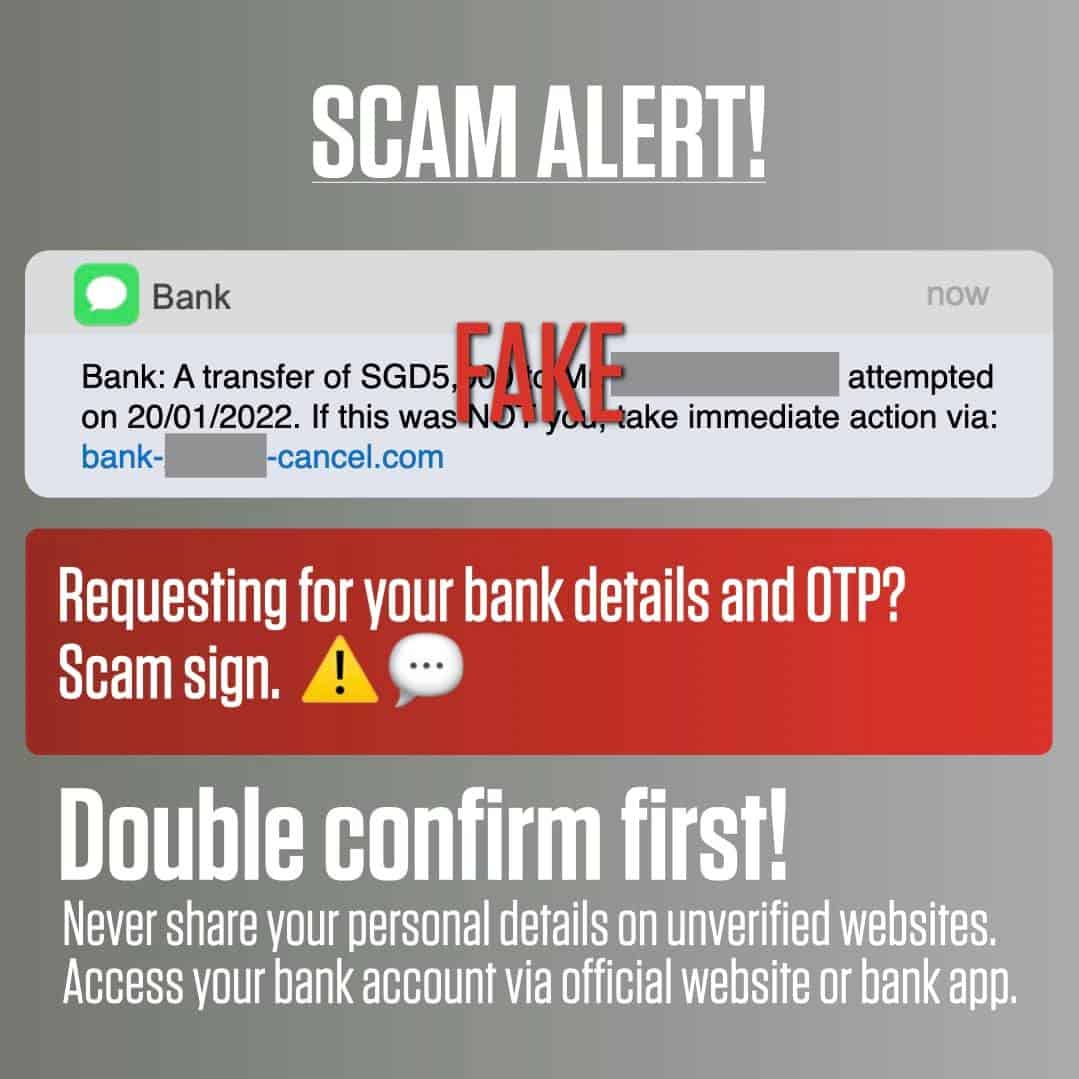

3) Banking-related Phishing Scams

Be sceptical of all requests for your personal and bank information even if they might seem to come from legitimate organisations. Scammers can spoof numbers belonging to banks, making their messages regarding suspended ATM cards or unauthorised transactions seem legitimate. Victims are tricked into giving away their banking passwords or paying non-existent fees. In reality, financial institutions would never call a customer to ask for their details.

Tip: If you receive a message claiming to be from your bank, don’t respond to the same number. Instead, call your bank’s hotline to check if the message is real.

- Always log in to your account via the official website or app

- If in doubt, verify the request directly with the organisation through their official channels.

- Look out for requests that require your urgent attention or sound threatening

- Never share your personal information on unverified websites.

- Do not click on links in dubious messages or emails.

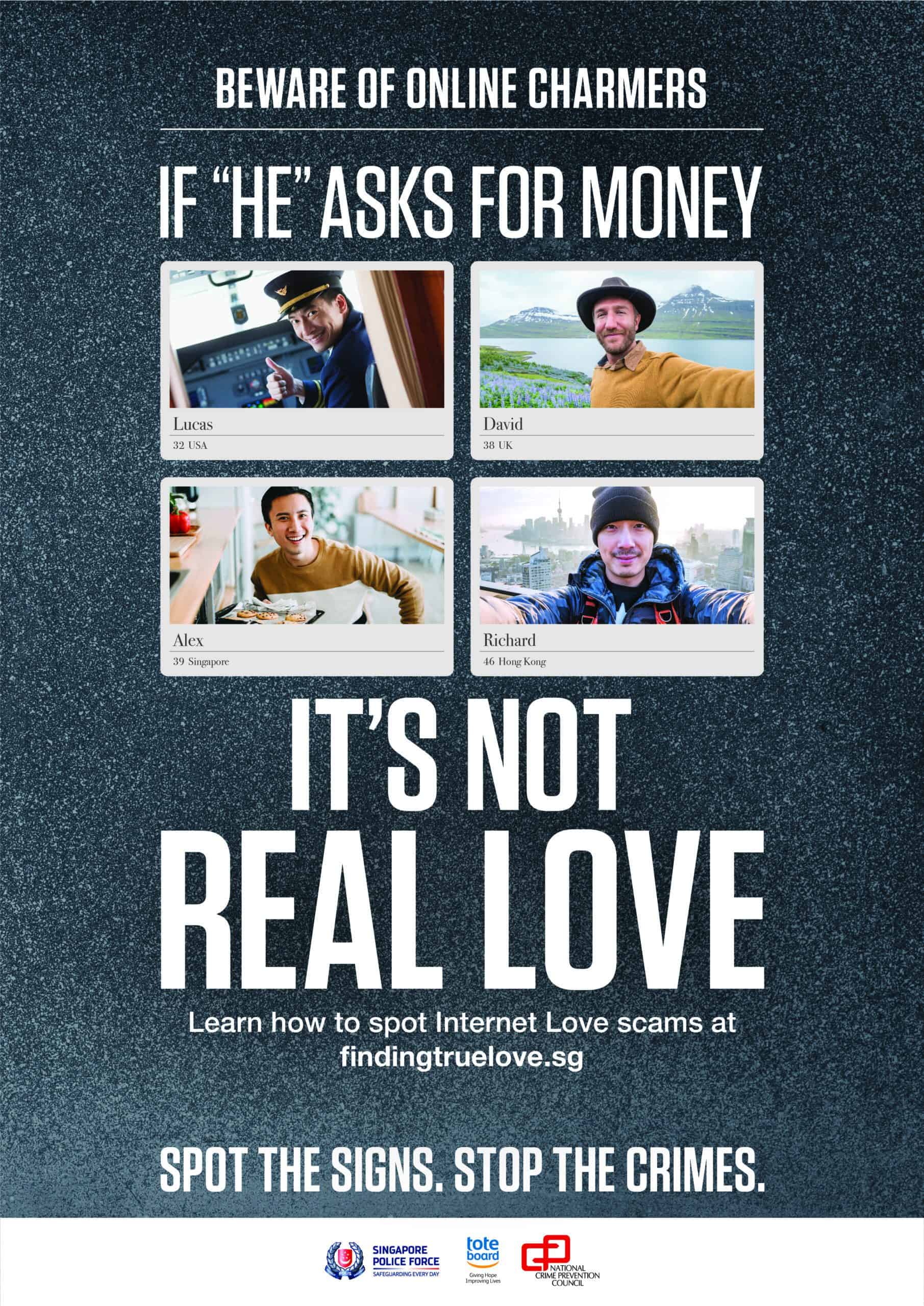

4) Internet Love Scam

After befriending an attractive person (who is usually foreign) online, he or she tells a tale about falling into trouble or hard times. The scammer persists with the story to gain their victim’s trust and adoration, then asks for money as proof of love. Once the money is transferred, the scammer disappears.

What you should look out for:

- Professes their undying love very quickly after making contact with you

- Goes to great lengths to gain your interest and trust with loving words, and even offers to send you gifts

- Gives excuses whenever you ask for a video call

- Sudden stories of misfortune and requests for money to help them out

- Sends you a huge LOVE pack consisting of luxury items including cash

Tip: Do not send money to anyone you have not met in person. Verify the identity of the person you are talking to with an online image search, here: https://images.google.com/ Always ask for a LIVE video call with the person.

5) Impersonation Scam

There are several variations of this scam. In many variations of this scam, it involves a phone call from someone purporting to be a government official (e.g. a police officer, immigration officer or court official) or staff from a bank or telecommunication service provider.

China Officials Impersonation Scam

In this scam, the caller might claim to be a government official, an employee or a representative of a Chinese bank or courier company. The caller might claim that your identity was used to send parcels containing fake passports or weapons or to apply for overseas credit cards. They then refer you to another caller claiming to be a Chinese official, who will ask — or even threaten — you to give them personal information such as your passport or bank account number, internet banking credentials or One-Time Password (OTP).

Tip: Note that no government agency or legitimate organisation will ask for your personal particulars, banking details or OTPs for any accounts over the phone. Never share your confidential info! Always verify the authenticity of the request for personal information by contacting the respective authority via their official hotline or email.

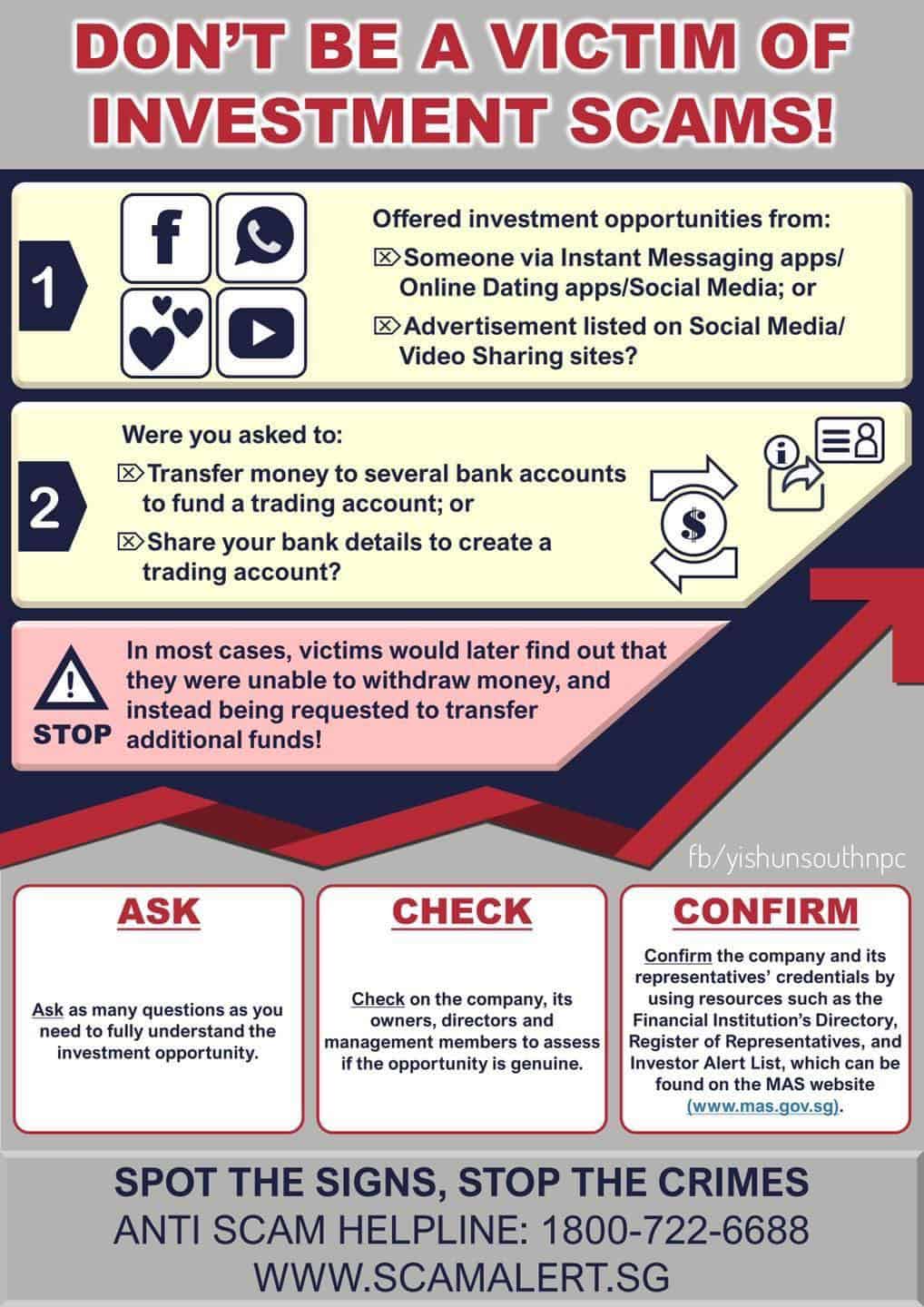

6) Investment Scam

Victims receive messages from people claiming to be stockbrokers or bank or financial company employees on social networking sites like Facebook, WeChat or Line. Responding to these messages leaves you vulnerable to an Investment Scam where fraudsters ask for personal details like NRIC and passport numbers. Scammers then ask victims to transfer money to banks in Hong Kong and China, pay administrative fees, security fees and taxes in order to receive the profits and returns.

Victims also receive phone calls from people claiming to be from the Hong Kong Monetary Authority or Hong Kong Overseas Control Centre, asking for a deposit before profits can be released to them.

Tip:

- Be cautious when befriending strangers on social media platforms.

- Understand that investments with high returns come with high risks.

- Always check with a licensed financial advisor before making any investment.

- Check if an entity is blacklisted on the Monetary Authority of Singapore (MAS) Investor Alert List. Deal with companies that are licensed and regulated by MAS.

- Ask as many questions as you need to fully understand the investment opportunity.

- Do a thorough check on the company and its representatives using resources such as the Financial Institution’s Directory, Register or Representatives, and Investor Alert List, which can be found on the MAS website (www.mas.gov.sg).

- Never provide your name, identification number, passport details, contact details, bank account or credit card details to anyone you do not know well.

- Be careful when dealing with unregulated entities as you will have little recourse if things go wrong. If an entity is based outside of Singapore, check if it is regulated with the respective overseas authority.

- Before committing to an investment, always Ask, Check and Confirm.

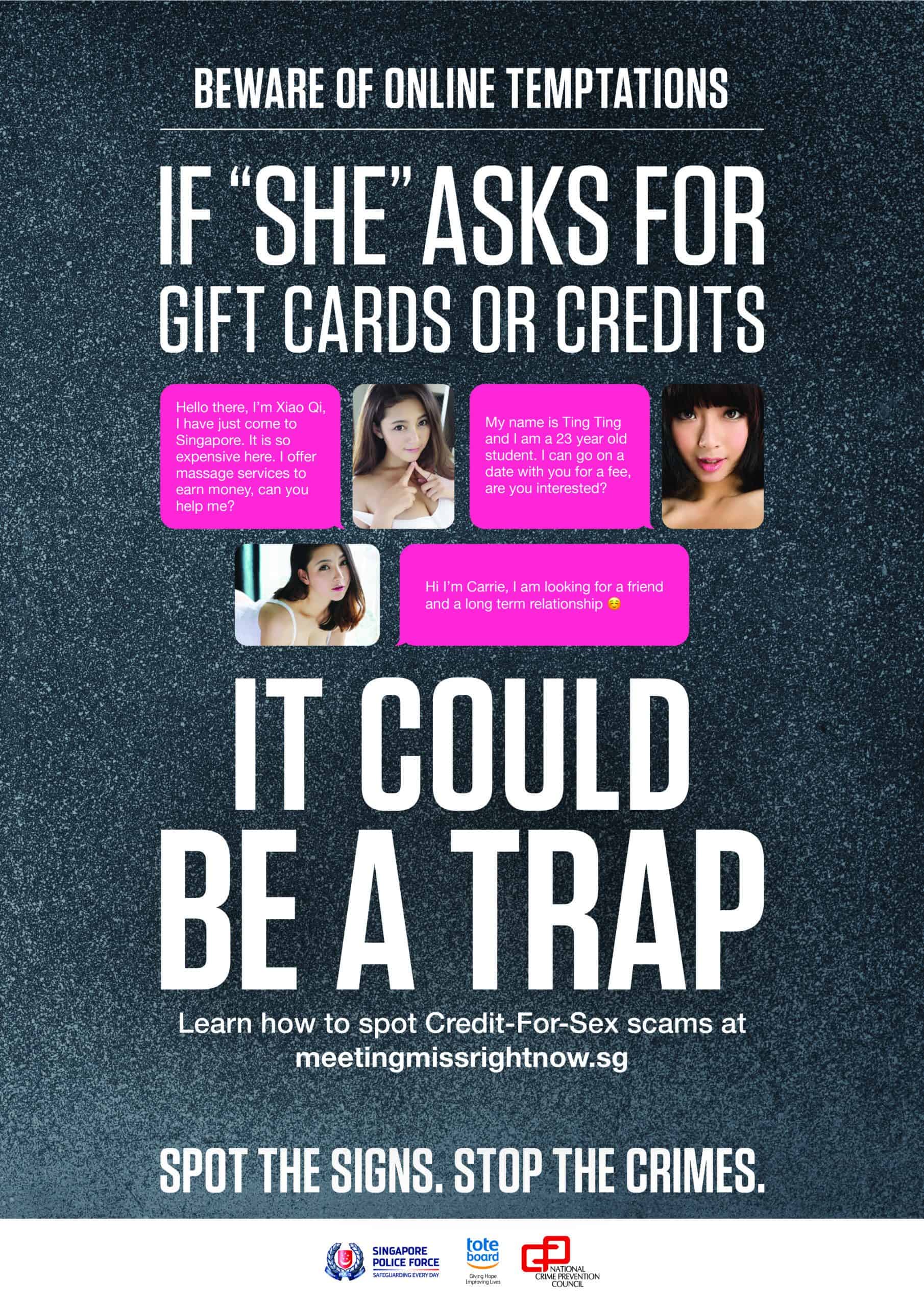

7) Credit-For-Sex Scam

A good-looking stranger messages a victim on platforms such as WeChat or Tinder, offering sexual favours in return for iTunes gift cards or AliPay purchase cards. Once the cards have been bought and sent, the stranger disappears, never to be heard from again.

Tip: Be wary of people offering sex in exchange for gift cards or shopping credits. Do not give personal details or receipts showing PINs to strangers you meet online.

Business Fraud & Scam

Identifying fraud is the first step in protecting your business from it. Below are some of the most common types of fraud business owners should be aware of.

Payroll Fraud

Payroll fraud can manifest in a variety of ways. An employee could lie about their productivity, sales or hours worked to get higher pay. Some may request a pay advance without any intention of paying it back. Others may even take it a step further by enlisting a co-worker to manipulate their attendance records by clocking in and out for them.

According to most studies, payroll fraud disproportionately affects small businesses because they are less likely to have anti-fraud measures and systems.

How to avoid it: Do background checks on every potential employee. Have managers closely monitor time sheets and use secure automated payroll services.

Asset Misappropriation/Skimming

Asset misappropriation is one of the most common types of business fraud, but it is also one of the easiest to spot. Watching out for forged checks, missing inventory and accounts that simply don’t add up is key to identifying asset misappropriation. You could also fall victim to skimming, which is the act of taking money from either a customer or the company without recording the transaction.

How to avoid it: Rotate cash-handling staff and do not entrust all financial tasks to one employee.

Invoice Fraud Schemes

This type of fraud happens when the fraudster (often an employee in sales or accounting) creates fake invoices to steal money from the business. This could mean invoicing for products and services that were never bought, creating a fake supplier/shell company to funnel the money to, or awarding over-inflated contracts to personal friends and family.

How to avoid it: Cross-check every invoice with actual goods and services purchased. Do comprehensive background checks before approving a new supplier.

Data, Intellectual Property and Identity Theft

A lot of businesses handle sensitive information, whether personal data or intellectual property (IP). IP theft can damage your business if an employee leaks trade secrets and patents to your competitors. Identity theft can hurt your reputation due to lower customer trust.

How to avoid it: Restrict access to high-level documents. Have a security policy in place for the classification and handling of sensitive information.

Think You’ve Been Scammed?

Cancel your credit cards and inform your bank so that they can flag any suspicious transactions. Report the incident to the police and make sure to save all interactions with the scammer — take a screenshot of all text messages and emails, so that you have evidence. Even if the money can’t be retrieved, helping to catch the scammer will ensure that no one else will be conned.

Any information relating to such crimes can be reported to the police hotline at 1800-255-0000 or submitted online. For urgent Police assistance, please dial ‘999’.

More scam-related advice can be found via the anti-scam hotline on 1800-722-6688 or at this website.

Subscribe to our mailing list to get the latest updates and learn more about our 2022 programs!