How Does a Home Loan Work in Singapore?

Buying a home in Singapore is a substantial financial commitment that almost everyone goes through at some point. Whether you’re a newly married couple or single, purchasing an HDB flat or private property, it’s advantageous to understand how a housing loan works in Singapore.

Understanding them can help you spend less on your property, ultimately contributing to better resale gains and keeping your home affordable.

Read on to find out what you need to know about home loans in Singapore.

What is a home loan?

An HDB loan or home loan is money borrowed from HDB or the bank to help you buy your property. For HDB flats, you may also be able to tap on housing loans at a concessionary interest rate, subject to HDB’s criteria.

With a home loan:

- Your property is used as collateral for the loan

- The amount granted is based on eligibility

- The loan is disbursed after the downpayment is made when you pay the remaining purchase price to the seller.

- Interest is charged from the first disbursement

You have to use a bank loan for private property and ECs, as HDB does not provide loans. In addition, some buyers may not qualify for an HDB loan, even if they’re buying a flat. These buyers will have to use a bank loan.

How to qualify for a home loan?

HDB and the banks will have their eligibility criteria for prospective borrowers. These include:

- Minimum monthly income

- Buyer’s minimum and maximum age

- Loan quantum

- Residency status

- Fulfilment of the Monetary Authority of Singapore’s property loan rules and HDB’s/the bank’s internal credit requirements

If you are self-employed or do not have a regular income, you must demonstrate the ability to service monthly instalments to be eligible for a loan. Each lender will assess your eligibility based on its criteria.

If you are a foreigner, note that Singapore banks are also subject to Know Your Customer (KYC) and other compliance issues; they may require additional documentation and proof.

Approval In-Principle

An Approval In-Principle (AIP) is a great way to kick off the process as it is a way to gauge how much a bank will lend you based on your income and current liabilities before committing to a property purchase. You can consider whether you can afford to service the monthly repayment instalments. You will not need an Option To Purchase to apply for one, and all it involves is providing your income-related documents to a bank for assessment.

Two other important considerations are the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR).

Note that an AIP is not binding; the approved loan amount may differ from AIP after the bank processes the application.

Mortgage Servicing Ratio (MSR)

The mortgage servicing ratio (MSR) refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans, including the loan being applied for.

MSR is capped at 30% of a borrower’s gross monthly income.

It applies only to housing loans for the purchase of an HDB flat or an executive condominium where the minimum occupation period of the executive condominium has not expired.

Calculating MSR

When calculating MSR, FIs are to take into consideration:

- All the borrower’s property loans.

- At least 20% of the monthly debt obligation for any property loan where the borrower is a guarantor.

To calculate a borrower’s MSR, use the following formula:

(Monthly repayment instalments for all property loans / Gross Monthly Income) x 100% ≤ 30%

Total Debt Servicing Ratio (TDSR)

Many home buyers ask if the MSR is the same as the Total Debt Servicing Ratio (TDSR). The answer is no. The TDSR limits the amount you can spend on your monthly debt repayments (student loans, car loans, personal loans, etc.) to 55% of your gross monthly income.

These debt repayments include all loans you take, including (but not limited to) your mortgage. So this means if you have other outstanding loans (like car loans, credit card bills, or personal loans), it will all count in the 55%.

As mentioned, the MSR only applies to HDB flat and EC purchases. If you’re buying private properties, you only need to consider TDSR. Check out the Total Debt Servicing Ratio Calculator to determine how much you can borrow.

With a more restrictive mortgage framework in place today, do note that the following will also apply to your home loan:

Loan Tenure

The maximum loan tenure for housing loans is capped at:

- 30 years for HDB flats.

- 35 years for non-HDB properties.

Loan-to-Value Ratio (LTV)

The loan-to-value (LTV) ratio defines the maximum amount property buyers can borrow, whether the loan is from HDB or a bank. LTV ratios are implemented as a safeguard against over-leveraging by borrowers.

- HDB Loan LTV – Up to 85% of the purchase price/property value

- Bank Loan LTV – Up to 75% of the purchase price/property value

- Factors that may affect your LTV – The property’s lease, location and condition, your age and credit score

Types of Housing Loans in Singapore

After you’ve decided on the property, you’d like to purchase. The next step is to determine how to finance it.

- If you’re buying an HDB flat, you can choose to take an HDB Concessionary Housing Loan or a bank loan.

- If you’re buying an EC or private property, you can only choose a bank loan.

HDB Housing Loan

HDB offers a concessionary loan for HDB buyers only, at an interest rate pegged at 0.1% above the CPF Ordinary Account interest rate. This interest rate is revised in line with the revision of CPF interest rates.

HDB Housing Loan Eligibility

To be eligible for the HDB loan, flat buyers must meet the following conditions:

| Citizenship | At least one buyer is a Singapore Citizen |

| Household Status | – Have not previously taken two or more housing loans from HDB – Last owned property is not private residential property* (local or overseas)*This includes a Housing and Urban Development Company flat or properties that are acquired by gift, inherited as a beneficiary under a will or as a result of the Intestate Succession Act, or owned/ acquired/ disposed of through nominees. |

| Income Ceiling | Average gross monthly household income does not exceed: – $7,000 for singles buying a 5-room or smaller resale flat; or a new 2-room flat in a non-mature estate, under the Single Singapore Citizen (SSC) Scheme – $14,000 for families – $21,000 for extended families |

| Ownership/ Interest in Property | – Must not own or have disposed of any private residential property in the 30 months before the date of application for an HDB Loan Eligibility (HLE) letter – Do not own more than one market/ hawker stall or commercial/ industrial property – If the buyer owns only one market/ hawker stall or commercial/ industrial property, he/she must be operating the business there and have no other sources of income |

| Remaining Lease | Flat buyers may apply for an HDB housing loan up to the complete 90% Loan-to-Value (LTV) limit if the remaining lease of the flat can cover the youngest buyer till the age of 95 |

Before applying for an HDB loan, you’ll need to obtain an HDB Loan Eligibility (HLE) letter.

Bank Loans

Alternatively, you may wish to consider taking a housing loan from a bank or financial institution (private home buyers, you have no choice!).

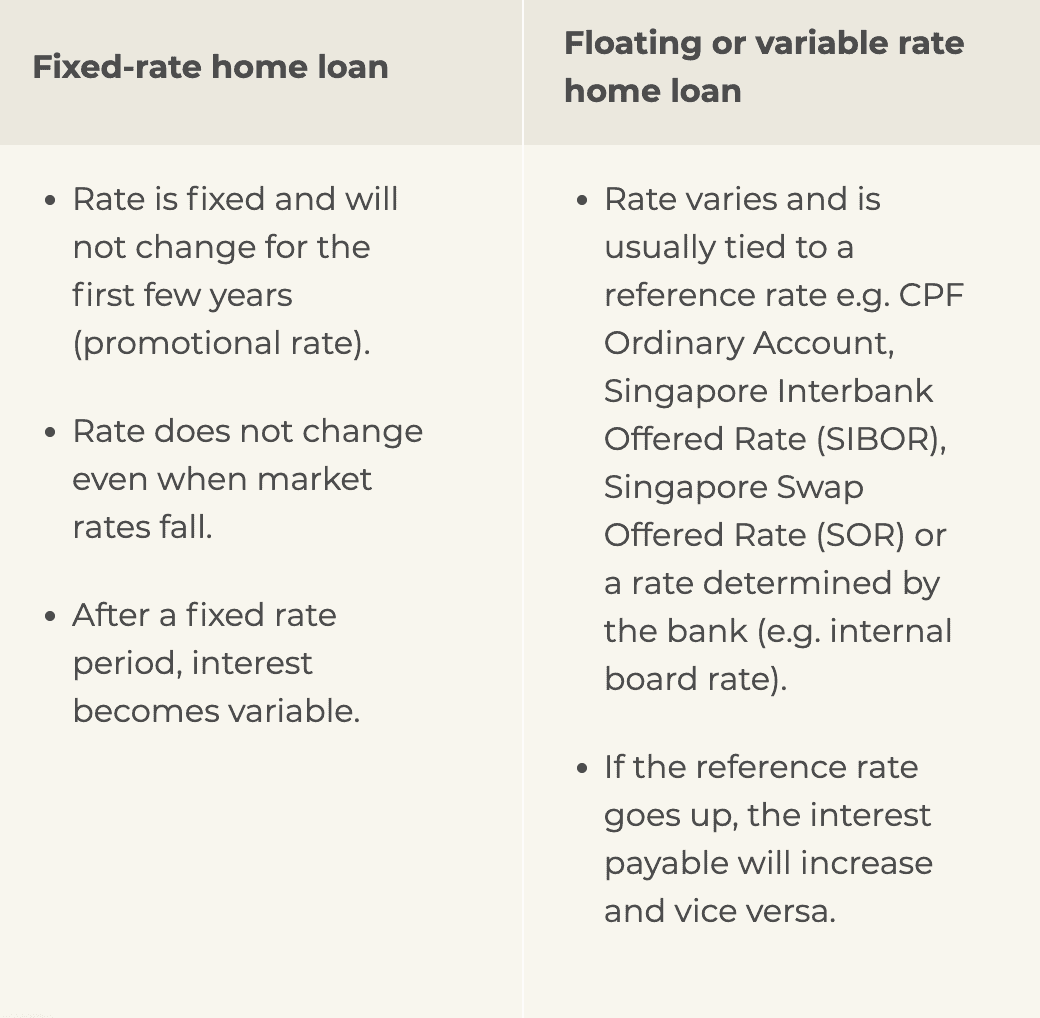

For banks, there are two main types of home loans:

- Fixed-rate loans

- Floating or variable rate loans

Here’s how they compare:

Source: moneysense.gov.sg

Source: moneysense.gov.sg

To understand the differences between the various bank loan packages better, ask your bank to explain:

- How the reference rate is derived

- How often this interest rate may be reset

- Under what circumstances the rate is changed

- What special features, if any, apply and if these will be removed or amended later

Note: A promotional rate is lower than the rate for the remainder of the loan. Ensure you know how much your monthly payments will increase when the promotional period is over.

How to Apply for a Bank Housing Loan

The first step to securing a housing loan from a bank is to get an Approval In-Principle (AIP). As a conditional approval for your housing loan, AIP indicates how much you can borrow from the bank and the various loan packages available, so you can better understand which properties are suitable for your budget.

Once you’ve decided to sign a loan package with the bank, you’ll be given a Letter of Offer that states all the essential information, such as the loan amount, interest rate and lock-in period. With this Letter of Offer, you’ll be able to exercise your Option to Purchase and proceed to buy the property.

Some standard documents you’ll need include:

- Copy of your NRIC

- Most recent payslips (3 months)

- Most recent Notice of Assessment (2 years)

- Latest CPF Ordinary Account Statement

Property loan fact sheet

Before you sign up for a home loan with a bank, the bank must provide you with a property loan fact sheet.

It highlights how possible increases in interest rates will affect your monthly instalments and contains the key features of the loan, including:

- Loan amount and tenure

- Total repayment amount

- Lock-in period

- Interest rate and repayment schedule

- Rate change illustration

- Effective interest rate

- Penalty fees

Ask your bank to take you through the fact sheet so that you know what you are committing to when you take up the loan.

Refinancing and repricing

Refinancing means switching your existing home loan to a new lender with lower interest rates. Refinancing at your current bank is called repricing or conversion.

You should review your home loan regularly to see if you can save money by refinancing, mainly if your lock-in period is over.

Note: HDB flat buyers are not allowed to refinance their existing bank loan with an HDB loan.

What if you can’t pay?

If you have trouble keeping up with your monthly payments, approach your mortgagee quickly (HDB or the bank). HDB may advise you on alternative options better, while the bank may be able to help you restructure the loan.

Your home loan is secured against your property. In case of a loan default, HDB or the bank has the first charge, and the CPF Board has a second charge on your property if CPF savings have been used for the downpayment or to service the loan.

If you fail to make the home loan payments when they are due, the first charge allows HDB or the bank to sell your home and use the sales proceeds to pay off what you owe the bank.

The CPF Board is entitled to the remaining sales proceeds to recover what has been deducted from your CPF OA.

Need more advice on home loans? Make financing your dream home a breeze with Workwell loan partners. Email natalie.mortgage@workwell.sg or contact us at +65 8201 0307 to find out more.

Subscribe to our mailing list to get the latest updates and learn more about our 2022 programs!